As of February 2022, shares of Nestle India are floating in the market at a price of more than Rs 18,000 per share and the shares of HUL are floating at over Rs 2,000 per share. You may not be much of a trader, but what if you got to know that you actually happen to own some shares of these companies? This happens when the recovery of shares is overdue. Let's learn more about what they are and how they could make you a fortune.

Role of IEPF in the case of unclaimed shares

The government of India created the Investor Education and Protection Fund (IEPF) to educate investors and safeguard them from losing control of their assets and stock. There are innumerable instances of investors failing to appoint a nominee for their shareholdings. This means that if the investor passes away, their investments are transferred to the government along with any unclaimed dividend money. These funds may then be used by the government as they deem fit unless the investor's rightful heirs make their claim. The IEPF allows and encourages investors to contact the government to demand their dividends and request that their long-forgotten shares be refunded thereby facilitating lost shares recovery. The IEPF was established with the shareholders' best interests in mind and it helps safeguarded the monies of investors while also raising awareness about the issue.

Investors can petition the government to receive the unclaimed dividends and unclaimed shares up to 7 years after they were deemed lost. Typically, people used to approach respective companies individually to get information about and then collect their dividends and shares. However, the IEPF is a one-stop solution that enables the public to claim their rightful inheritance from multiple companies through a single channel when it comes to the matter of recovery of unclaimed shares.

Why Nestle can be your ideal investment

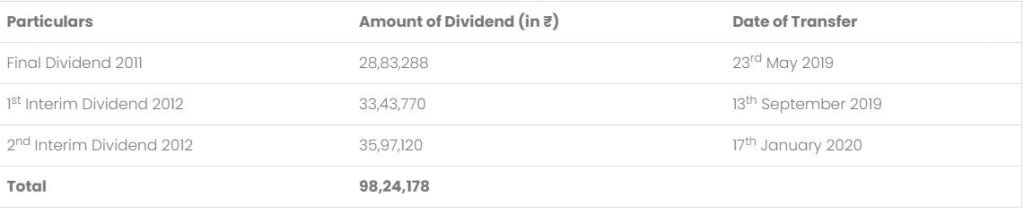

The present status of the dividends and shares of a firm that are transferred to the IEPF account is stated in the company's annual reports. All unclaimed dividends dating back to the financial year 1995-1996 that remained due and unclaimed with the business were transferred to the Central Government's general revenue account, according to Nestle India Ltd.'s Annual Report for 2019-2020. Below is a snapshot of the value of the latest dividends that were transferred and are now up for IEPF claim.

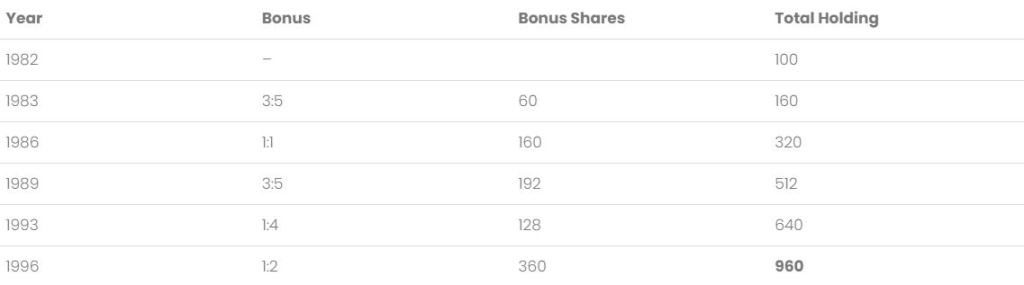

Over the years, Nestle has also rewarded its investors with a generous number of bonus shares. Below is a history of bonus shares announcements by the company and what it means for an investor.

100 shares of Nestle India owned in 1982 would turn into 960 shares less than 15 years later. This coupled with the generous dividends that the company pays makes it a hugely profitable investment. To date, the company has distributed 60 dividends totaling Rs 1,292.5 per share to its shareholders. As per the latest available data, the company most recently announced a dividend of Rs 196 per share.

Let's visualise the financials at stake in this case with an example.

Let's assume you have 500 shares of Nestle India Ltd. registered under your name. The price of 1 share of Nestle India Ltd. as of February 2022, is Rs 18,515. Therefore, the value of your shares as of today is Rs 18,515 x 500 shares = Rs 92,57,500 (Ninety two lakhs, fifty-seven thousand and five hundred rupees).

However, this only takes into account the share price and not the dividends attributed to those shares. The amount of dividend received thus far (from 2001) is Rs 1,292.5 x 500 shares = Rs 6,46,250 (Six lakhs, forty six thousand, two hundred and fifty).

Dividend received in the latest financial year amounts to Rs 196 x 500 shares = Rs 98,000 (Ninety eight thousand).

Putting all these figures together makes you a crorepati!

Assume you made a long-term investment in this firm and then completely forgot about its stock. Alternatively, you may have inherited some shares from a deceased family member that you were unaware of. As a result, you would not have claimed any dividends on these shares for the past seven years. In this case, the shares would have been moved to the Government's IEPF account, and they are no longer in your ownership. This does not necessarily imply that you are no longer the legal owner of such shares. The main difference is that the government holds your shares and dividend amount in trust on your behalf. You can always make an IEPF shares claim from the government.

How Rs 2430 invested in HUL in 1978 can be worth over Rs 13 crores today

Hindustan Unilever Limited's stock has risen dramatically over the years, prompting the company to issue bonus shares and divide its equity. We'll see how, at today's rates, even a small investment in Hindustan Unilever Limited could be worth crores. Let's look at a hypothetical situation to better comprehend the growth of the company.

Suppose an investor had 900 shares of Hindustan Unilever Limited registered in 1978 which would have cost approx Rs 1200 considering the share price of HUL at the time was around Rs 2.7 per share. The prices of Hindustan Unilever Limited shares have kept on increasing since 1978 and the company has announced bonus shares on numerous occasions during that time period as well. As a result of those bonuses and the share splits announced by HUL, those 900 shares will be equivalent to 57,600 shares today.

This means that as per February 2022 share prices, you would stand to gain a fortune of 57,600 shares X Rs 2,332.95 = Rs 13,43,77,920 (Thirteen Crores, forty-three lakhs, seventy seven thousand, nine hundred and twenty).

The above figure only accounts for the share price and not the dividend declared. HUL has declared both interim and final dividend over the years which has been exponentially rising. In 2021, the company declared a mammoth dividend of Rs 17,000 per share! The calculator of the payout basis 57,600 shares in the previous example is something that we will leave to you.

IEPF shares recovery process

The process of IEPF recovery is rife with hurdles and often specialised knowledge from experts may be required. It involves the following steps:

- The shareholder should contact the company's nodal officer to obtain all pertinent information on owned shares and the claim procedure. The investor will be given a list of papers that must be provided with the claim form by the nodal official.

- The investor must next visit the IEPF website to complete the IEPF claim This may be done by inputting personal information as well as information on stock ownership.

- After submitting the claim form, the claimant should print it out and gather all of the required papers, which are listed on the IEPF website and by the Nodal officer.

- After compiling the file, the claimant should email it to the Nodal officer, who will double-check the information and documents. He'll look into the ownership of the shares and double-check the information.

- The nodal officer generates a claim verification report based on the supplied information and transmits it to the IEPF Authority fund manager within 15 days of receiving it.

- After the fund manager receives the verification file, he or she begins to examine it, as well as the application form and other papers.

- Following verification, the fund manager makes a decision between the following options:Through the nodal officer, he might request more documentation from the claimant.

He has the right to reject the application if there is a mistake or if the claimant has not provided all of the required papers.

After verification, he might approve the claimed shares or dividends.

Making your IEPF claim

By now we have learned how HUL or Nestle shares purchased decades ago may be worth crores in today's market. We have also learned how the process of recovery of shares from IEPF would be quite advantageous for investors, but tedious in nature. This is due to the fact that the procedure necessitates continual communication with nodal offices of the company, IEPF department, and registrar This may prove to be a lot of work for busy investors. This is where the team of experts at Infiny Solutions (add website hyperlink) can come to your rescue. Our experienced professionals have successfully completed the recovery of lost shares of Nestle, HUL, and many other companies for numerous clients over the years. If you think you may have inherited HUL or Nestle shares from someone in your family, we can help process your claim even if the share certificate in your possession is mutilated or you only have partial information about a potential claim. As part of our exclusive services, we facilitate the process through respective registrars, nodal officers, and IEPF till the very end when your claim is eventually sanctioned. All you have to do is sit back and wait for a fortune to be credited to your account!

Blog Source :- https://infinysolutions.com/forget-nfts-heres-why-nestle-and-hul-are-what-you-need/